Optimizing Medical Care Coverage With Medicare Advantage Insurance Policy

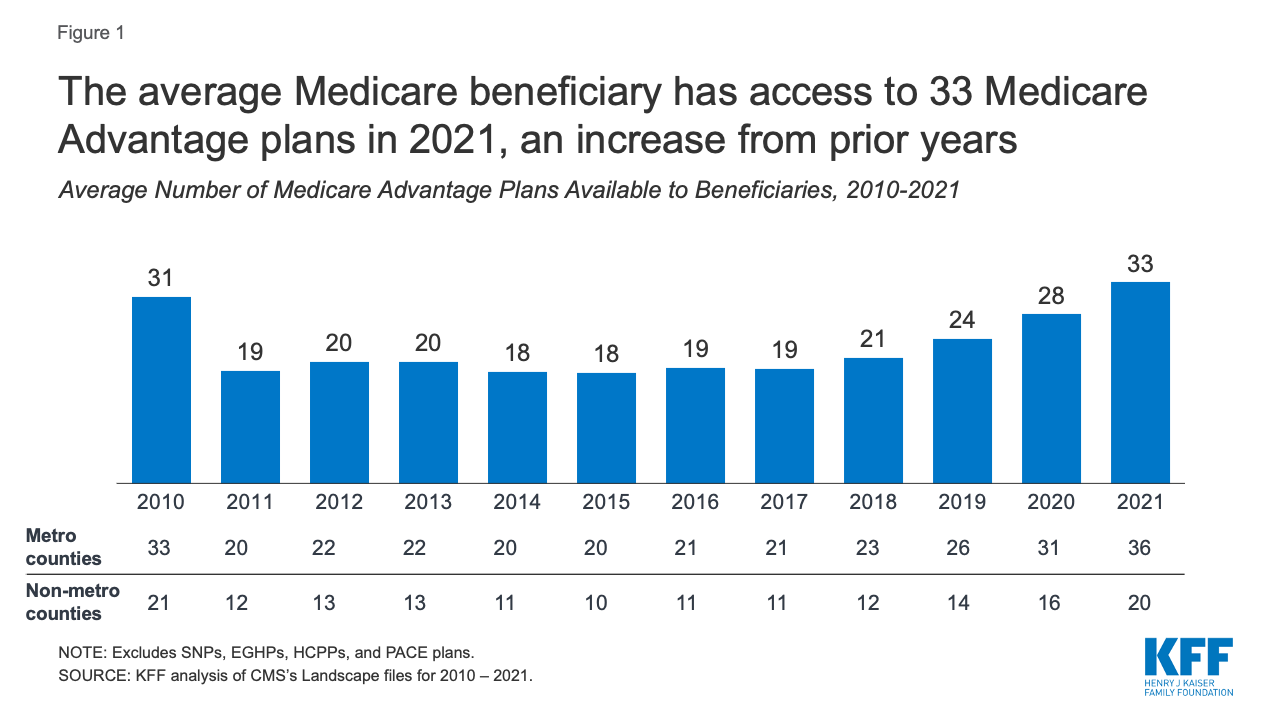

As the landscape of health care continues to advance, individuals seeking extensive coverage commonly turn to Medicare Benefit insurance for an extra inclusive strategy to their medical needs. The attraction of Medicare Advantage lies in its possible to offer a more comprehensive variety of services beyond what traditional Medicare strategies provide.

Benefits of Medicare Advantage

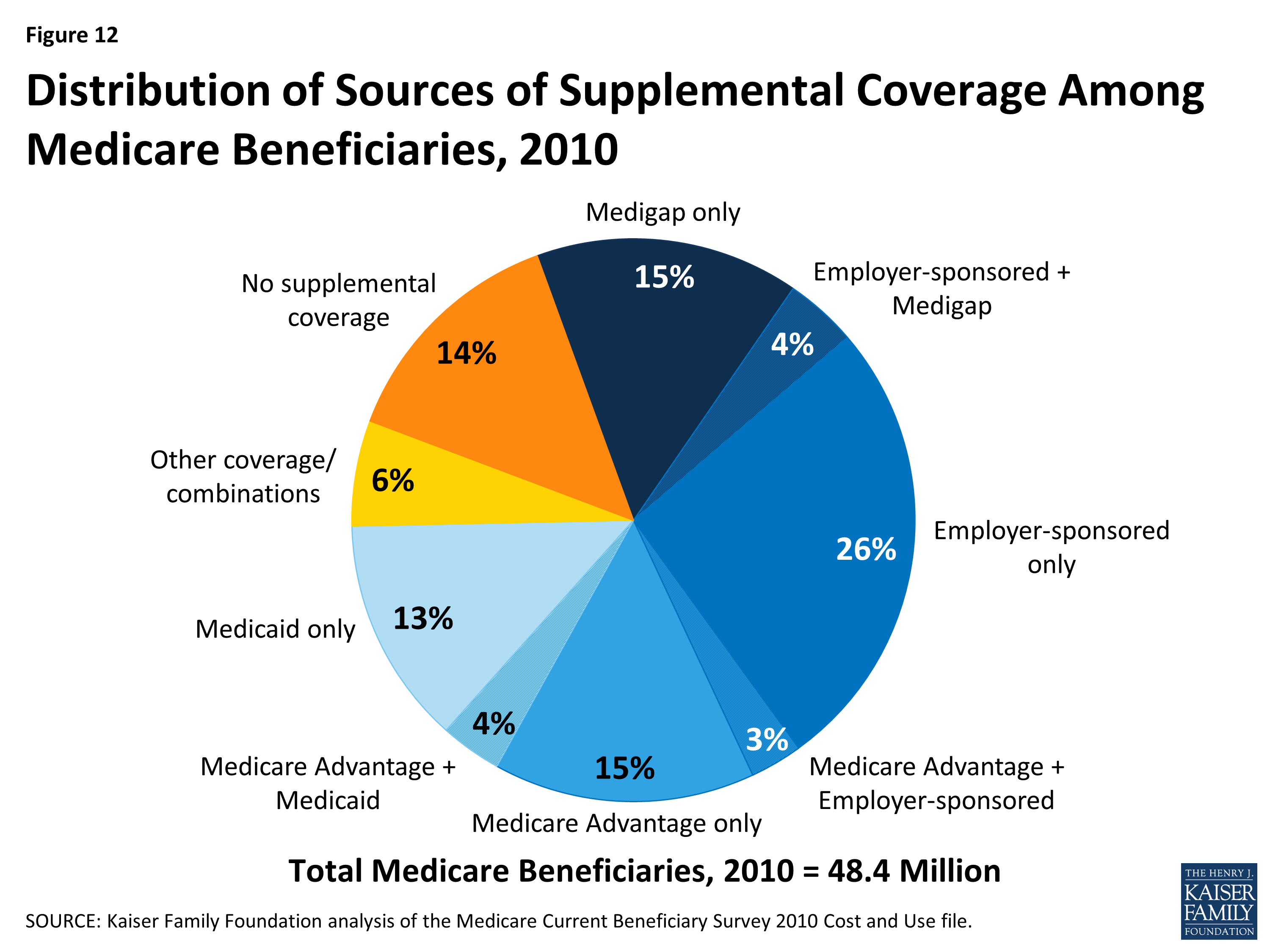

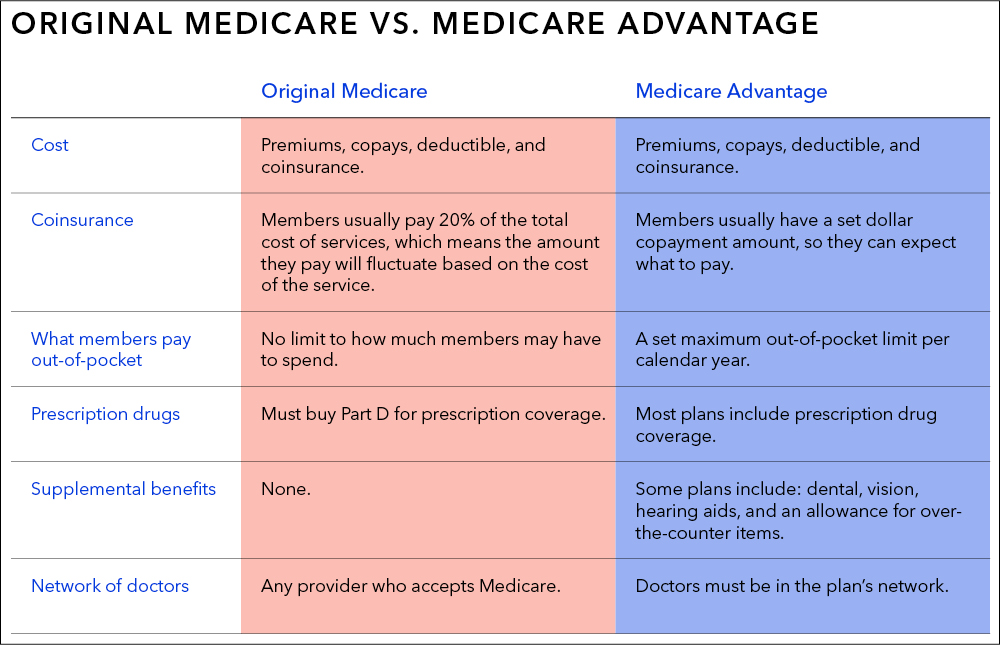

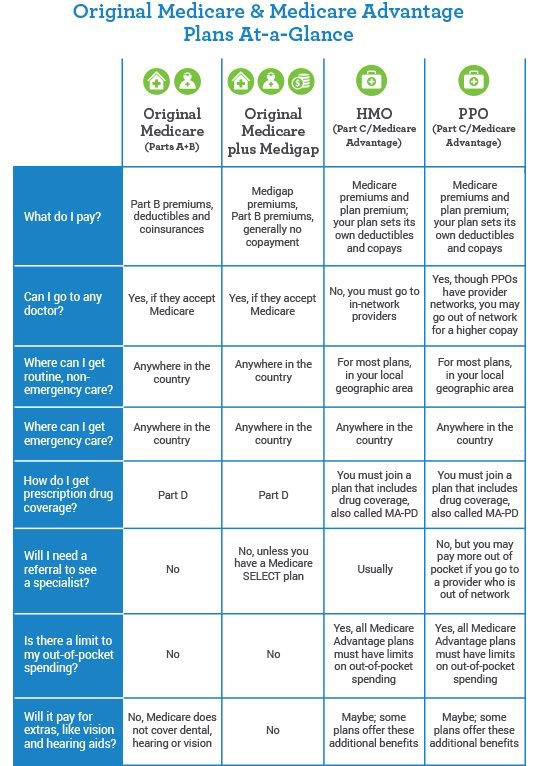

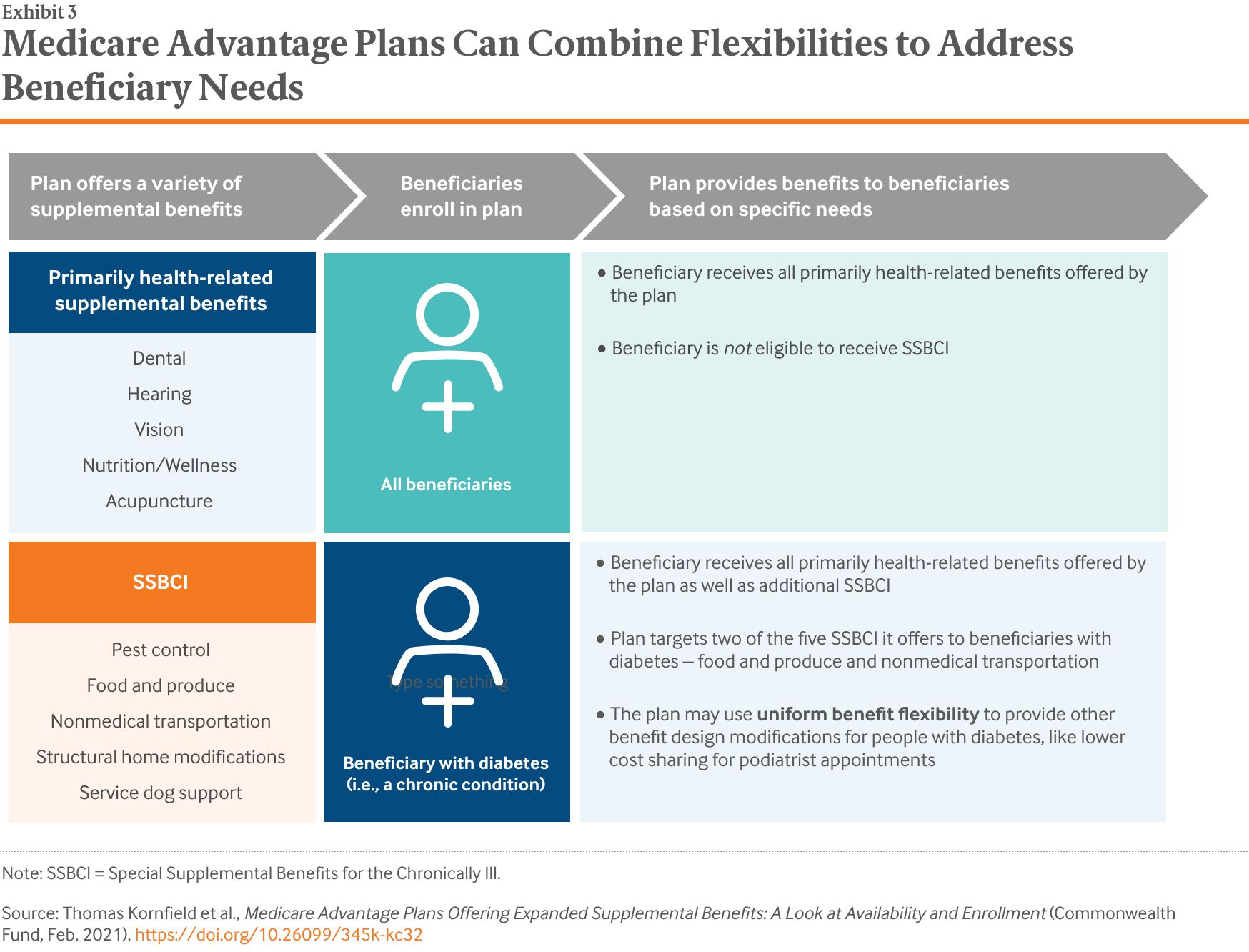

What advantages does Medicare Benefit offer over conventional Medicare plans? Medicare Advantage intends, likewise recognized as Medicare Component C, give numerous advantages that establish them besides typical Medicare strategies. One key benefit is that Medicare Advantage intends usually consist of added protection not supplied by initial Medicare, such as vision, oral, hearing, and prescription medicine coverage. This thorough coverage can assist beneficiaries conserve cash on out-of-pocket expenditures for solutions that are not covered by standard Medicare.

Furthermore, Medicare Advantage prepares generally have out-of-pocket optimums, which restrict the amount of money a recipient has to invest in covered solutions in a given year. This economic defense can give satisfaction and aid people budget plan for medical care prices extra successfully (Medicare advantage plans near me). Furthermore, several Medicare Advantage prepares offer health care and various other preventative solutions that can help recipients stay healthy and handle chronic problems

Registration and Qualification Standards

Medicare Benefit strategies have certain registration demands and eligibility standards that people must satisfy to register in these comprehensive health care coverage options. To be eligible for Medicare Benefit, people have to be enrolled in Medicare Component A and Component B, additionally called Initial Medicare. Additionally, most Medicare Advantage prepares require candidates to live within the plan's service location and not have end-stage kidney illness (ESRD) at the time of enrollment, though there are some exceptions for people currently enlisted in a Special Demands Strategy (SNP) tailored for ESRD individuals.

Cost-saving Opportunities

After guaranteeing qualification and registering in a Medicare Benefit plan, individuals can discover different cost-saving opportunities to optimize their healthcare protection. One substantial method to conserve expenses with Medicare Benefit is via the strategy's out-of-pocket optimum restriction. When this limitation is reached, the plan click here for more typically covers all added accepted clinical costs for the remainder of the year, offering economic alleviation to the beneficiary.

One more cost-saving opportunity is to utilize in-network doctor. Medicare Advantage plans usually discuss affordable prices with specific physicians, medical facilities, and pharmacies. By remaining within the plan's network, people can take advantage of these lower rates, eventually decreasing their out-of-pocket expenses.

Moreover, some Medicare Benefit intends offer fringe benefits such as vision, dental, hearing, and health programs, which can help people conserve cash on solutions that Original Medicare does not cover. Benefiting from these extra benefits can bring about considerable expense financial savings gradually.

Extra Insurance Coverage Options

Discovering auxiliary health care advantages beyond the basic insurance coverage provided by Medicare Advantage plans can enhance overall health and wellness and wellness end results for recipients. These added insurance coverage alternatives typically consist of solutions such as oral, vision, hearing, and prescription drug insurance coverage, which are not normally covered by Original Medicare. By availing these supplementary advantages, Medicare Advantage beneficiaries can address a broader variety of medical care needs, bring about improved top quality of life and much better health management.

Oral coverage under Medicare Benefit plans can consist of regular examinations, cleanings, and also major dental procedures like origin canals or dentures. Vision advantages might cover eye examinations, glasses, or contact lenses, while hearing protection can assist with hearing help and related solutions. Prescription medication coverage, likewise called Medicare Part D, is crucial for taking care of drug prices.

Moreover, some Medicare Benefit intends deal added benefits such as fitness center memberships, telehealth services, transportation support, and over-the-counter allocations. These additional benefits add to an extra extensive healthcare strategy, promoting precautionary care and timely treatments to support recipients' health and wellness and well-being.

Tips for Optimizing Your Strategy

Just how can recipients make one of the most out of their go to my blog Medicare Advantage plan protection while taking full advantage of medical care advantages? Here are some essential ideas to help you enhance your strategy:

Understand Your Coverage: Put in the time to assess your strategy's advantages, including what is covered, any limitations or constraints, and any kind of out-of-pocket costs you might incur. Recognizing your protection can help you make informed healthcare decisions.

Capitalize On Preventive Providers: Many Medicare Benefit prepares offer coverage for preventative solutions like testings, vaccinations, and wellness programs at no additional find here expense - Medicare advantage plans near me. By keeping up to date on preventive treatment, you can aid preserve your health and wellness and potentially stop much more serious health and wellness issues

Testimonial Your Drugs: See to it your prescription medications are covered by your strategy and check out possibilities to save money on prices, such as mail-order pharmacies or generic options.

Final Thought

In verdict, Medicare Benefit insurance coverage uses numerous benefits, cost-saving possibilities, and additional insurance coverage options for qualified individuals. By maximizing your strategy and taking advantage of these benefits, you can make sure extensive health care coverage.